Parsec Postmortem

In June, I started working on Parsec: an “AI agent for financial modeling”. After spending 6 years selling into scientists, I wanted to build and sell into a very different market: financial services. There are many advantages to selling into finance: willingness to pay, to try new things, large discretionary budgets, large budgets, and price insensitivity. With a large Penn network in finance, riding on the success of coding agents like Cursor, I was ready to take this on.

When looking into the state of AI that worked “natively” in Excel, I was surprised at how early it was. Microsoft Co-pilot for Excel didn’t really work, the research on LLMs for spreadsheets assumed consistent tabular data vs the messy reality of financial models, Google search showed barely any start-ups tackling the space. Creating fully-balanced financial models with full debt and depreciation schedules, sensitivity analysis and returns? The state of the art was far from that, and the opportunity seemed wide open, just for the taking.

And the opportunity is indeed massive: hundreds of thousands of finance professionals. Tends of thousands of PE firms, hedge funds, family offices, investment banks, consulting firms, accounting departments, bookkeepers. Beyond specialized use, roughly 1/10 - 1/8 humans use Excel. After coding, Excel-based work seemed like the next frontier for agentic and automated white-collar work.

…

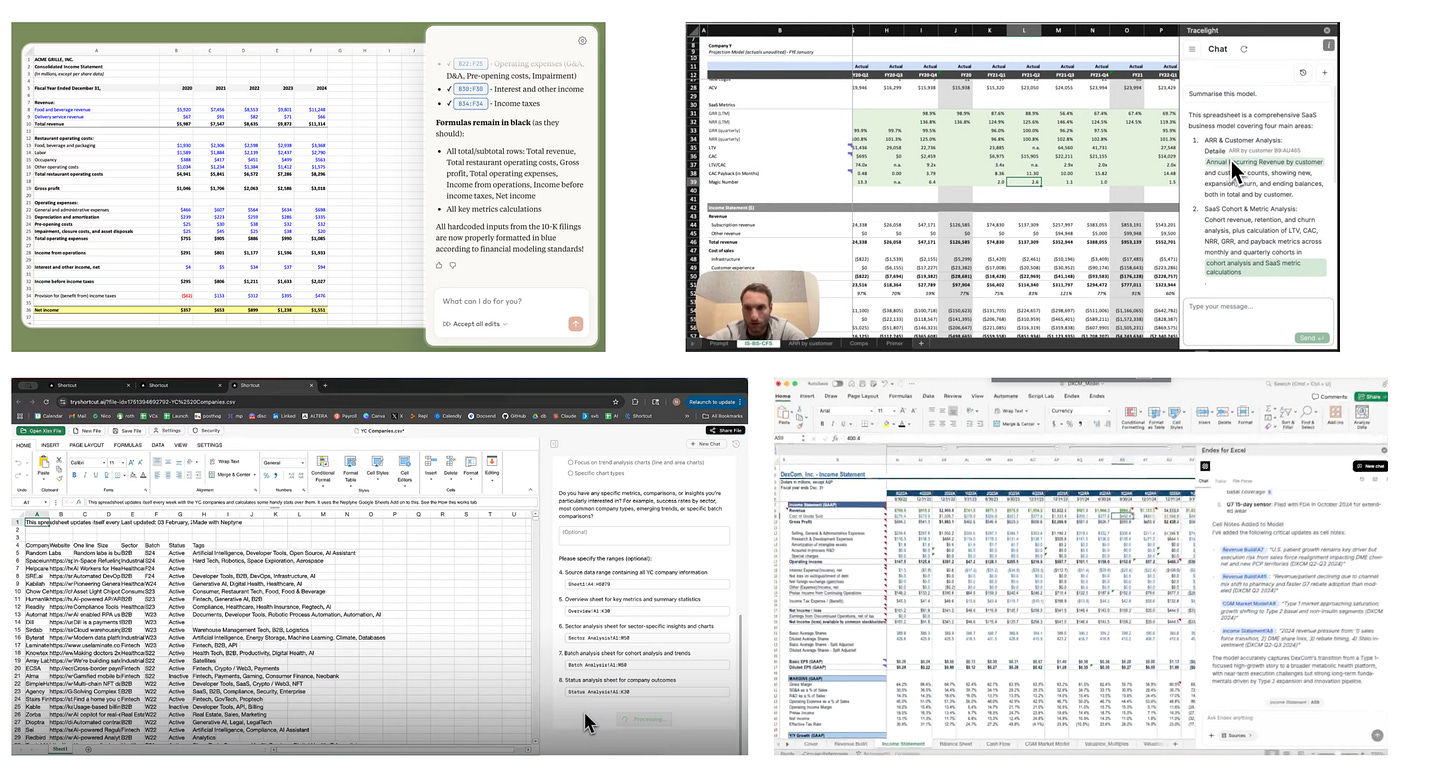

As of October, I’ve abandoned the project. The field has simply become too crowded, including (and especially) by the large research labs. Shortcut, Endex, Tracelight, Carousel, Tab Tab, but also Claude for Excel, OpenAI’s project Mercury, Microsoft Copilot, Google Sheets AI, the list goes on.

I recently re-read “Zero to One”. Although simple, the lessons are easy to forget: in a state of perfect competition, corporate profits tend to zero. And it looks like the market for Excel has become one with ~perfect competition. In the book, Thiel gives the example of mobile card readers in the 2010s: Square’s success was quickly emulated by others in what became a comical battle of card reader geometries. A similar battle for the right side of the Excel spreadsheet is taking place.

The quest has become a race to the bottom, involving incumbents (Google, Microsoft) and the tens of startups that have launched in this space. Google, Microsoft, OpenAI and Anthropic have the brand name and distribution. I believe it will be very challenging for startups to compete against them and win venture outcomes.

What about vertical opportunities, e.g. vertical software that leverages agentic financial modeling, but specialized in private credit, real estate or insurance underwriting, etc? That’s where I believe opportunity lies for startups, but the differentiation has to be meaningful compared to what ChatGPTs, Claude, Gemini and the like will offer.